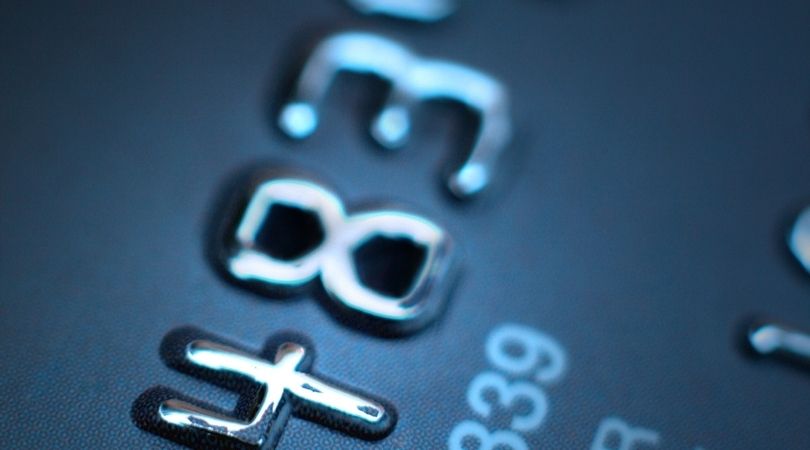

What do the numbers on your bank card mean?

When you receive a new bank card, whether it's a Visa card, Mastercard, or American Express, you'll likely notice a series of numbers on the front. These numbers are not randomly chosen and each has its own meaning and purpose. In this article, we will explore in detail the structure of these numbers and what they truly represent.

The role of the different numbers

Most bank cards have a 16-digit number. Each digit serves a specific purpose to aid in the identification of the card and ensures the security of transactions. Let’s break down these numbers to better understand them.

First, it’s essential to know the different segments of the card number, which include:

- The first digit

- The first six digits

- The next nine digits

- The last digit

First digit: identifying the industry

The very first digit of your bank card is used to identify the issuing industry. For example, banks and financial institutions typically use numbers starting with "4" for Visa, "5" for Mastercard, and "3" for American Express. This digit is crucial as it allows quick and efficient categorization of transaction types.

Knowing this digit can also help you instantly recognize the type of card you hold, even before looking at the rest of the numbers.

The first six digits: issuer identifier

The first six digits of your bank card number are known as the bank identification number (BIN) or issuer identifier. These numbers precisely identify the financial institution that issued your card. For example, if you have a debit card from a major bank, these six digits will be unique to that institution.

Within the global structure of bank cards, these first six digits play a fundamental role in transaction processing and fraud prevention. They enable payment systems to directly determine responsibility for each transaction.

The next nine digits: account number

The following digits, usually the seventh through the fifteenth, represent your personal account number. These numbers ensure that transactions are accurately charged to your specific bank account. Unlike the previous segments, this part of the card number is unique to each cardholder.

Understanding this section allows you to see how transactions are precisely and securely assigned to your individual account.

The last digit: control digit

Finally, the very last digit of your bank card number is called the check digit or validation number. This digit is generated using a complex algorithm called the “Luhn Algorithm.” It helps verify that the card number has not been incorrectly entered during payments or online operations.

While this digit may seem less significant at first glance, it plays a crucial role in protecting against common human errors when entering card numbers.

CVV or CVC number: what is it?

You may also notice an additional code on your card, often composed of three or four digits on the back. This code is called the CVV (Card Verification Value) or CVC (Card Verification Code). This number is required to complete certain online payments, providing an extra layer of security.

Having this code ensures that even if someone gains access to your card number, without physical control of the card, it becomes much harder for them to carry out fraudulent transactions.

Additional functions of card numbers

Beyond the obvious roles mentioned above, card numbers are also used for several other purposes. This includes risk management, fraud prevention, and ensuring smooth transaction processing.

Additionally, these numbers allow financial institutions to monitor their customers’ spending habits, making it easier to detect early signs of suspicious behavior that could indicate potential fraud.

Examples of card numbers

To better illustrate the points discussed earlier, here are some fictional examples showing the general structure of card numbers:

| Card Type | Card Number Example | ||

| Visa | 4123 4567 8901 2345 | ||

| Mastercard | 5123 4567 8901 2345 | ||

| American Express | 3782 456789 01234 |

Practical tips for managing your bank card

Managing your bank card requires more than simply understanding its numbers. Here are some practical tips to ensure optimal use of your card:

- Never share your full card number or CVV/CVC with untrusted parties.

- Be cautious of phishing emails requesting your card details.

- Use monitoring services to track suspicious transactions.

- Regularly change your PIN codes to strengthen security.

By keeping these tips in mind, you can not only understand the structure of your card number but also ensure better protection against potential fraud.

How to block a direct debit: everything you need to know

Open an online account without deposit and documentation

Similar articles

Advantages of playing online using a prepaid card

Fake Expense Reimbursement: A Fraud That Traps Even Savvy Professionals

The information provided on this blog is presented for informational purposes only and has no contractual or legal value. Although we strive to ensure the accuracy, completeness and updating of the published content, it may contain errors, omissions or inaccuracies. Carte Veritas and the authors of the articles cannot be held responsible for decisions or actions taken based on the information contained in this blog. Any use of this information is made at your own risk and under your sole responsibility. We encourage you to consult a qualified professional or an expert for any important question or decision relating to the subjects discussed. In addition, the information presented on this site may be modified or updated without notice. By visiting this blog, you agree that Carte Veritas and its partners are released from any liability concerning losses, direct or indirect damages, or consequences arising from the use of the contents of this site, whether they are linked to errors, omissions or the interpretation of the information published.